snohomish property tax due date

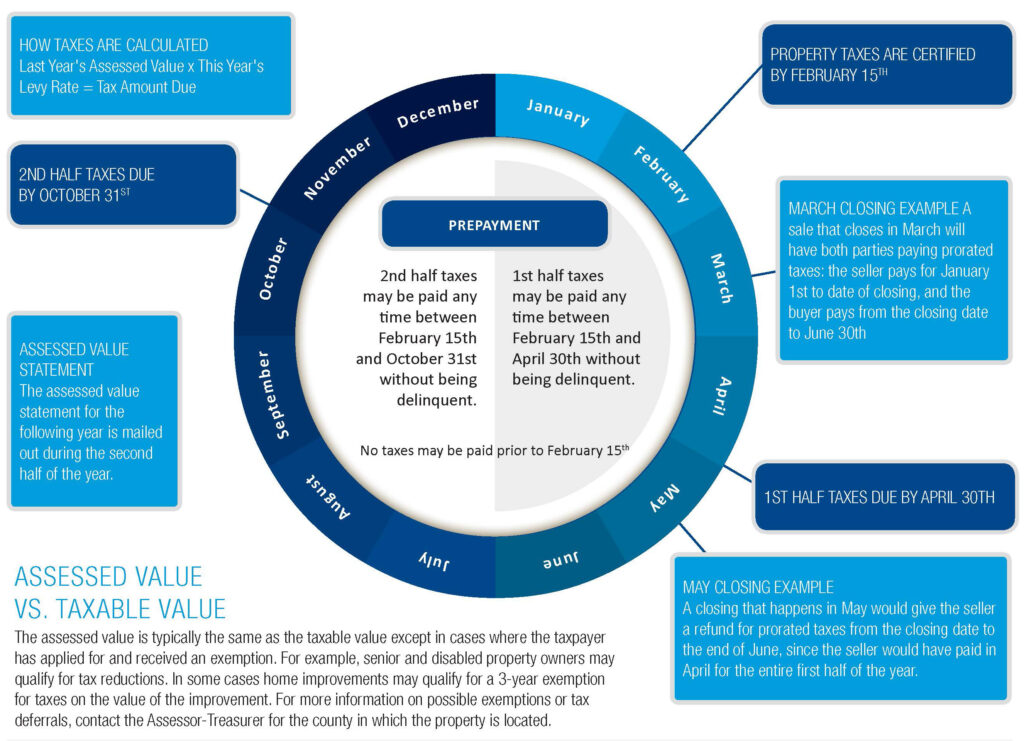

If you would prefer to pay off the entire balance in one payment on April 30th that is. First half taxes are due and payable without penalty on or before January 10 2022.

Snohomish Pud Releases New Mysnopud App Lynnwood Today

First half taxes are due April 30.

. Finance mails property tax bills four times a year. Using this service you can view and pay them online. Deadline will now be June 1 2020.

You either pay your property taxes two or four times a year depending on the propertys. 089 of home value. As tax bills are sent out in December any person who purchases property in Suffolk County during the following year should contact the Receiver of Taxes to determine if all taxes are current.

Second half taxes are due October 31. The Property Tax Division is divided into two units. In case you missed it the link opens in a new tab of your browser.

If youre a Snohomish County property owner youre responsible for paying property taxes to the county. Mail processing of payments may take until May 15th for the first half and November 15th for the. Yearly median tax in Snohomish County.

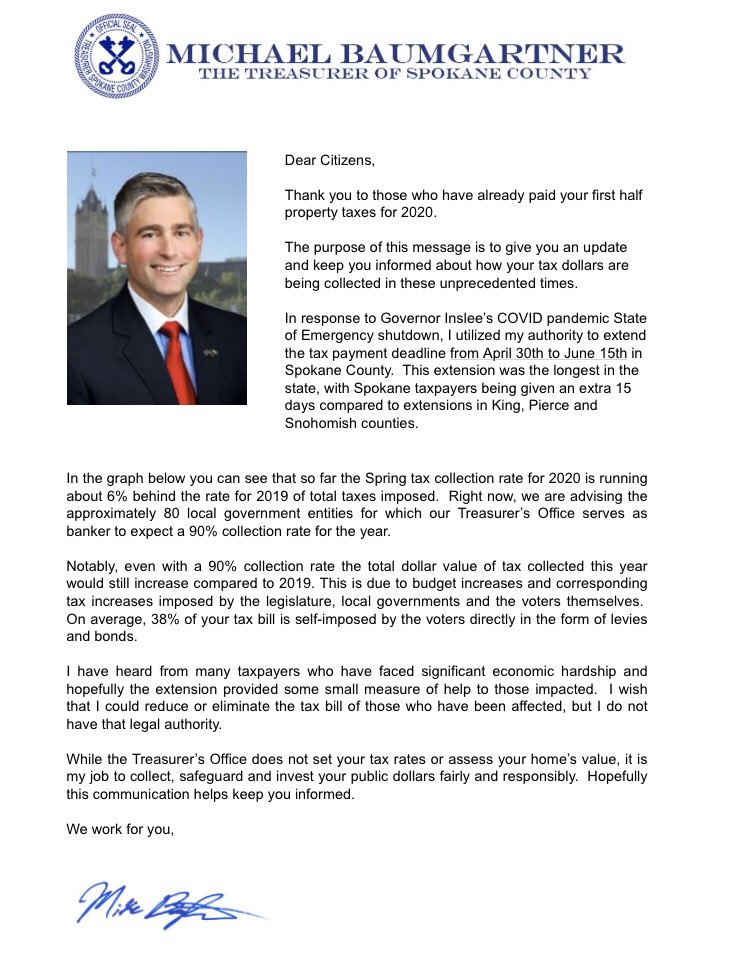

Our division is responsible for the determination of the annual equalized full value. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local property. Pierce and Snohomish county officials said in their Monday announcements that those who can pay now are still encouraged to do so by the April 30 original deadline or as.

The amount of tax you owe is based on the value of your property. EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County. NYCs Property Tax Fiscal Year is July 1 to June 30.

The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of. Spokane County has extended the deadline to June 15 th. If paying after the listed due date additional.

Snohomish County property taxes are due on April 30th and October 31st each year. Municipal Services and the Unorganized Territory. Learn all about Snohomish County real estate tax.

Taxes are due and payable in full upon receipt OR you may choose the option of paying in two halves. King Pierce and Snohomish County have extended the payment due date for property taxes to June 1 st 2020.

About Our District 2022 Snohomish School District Proposed Replacement Levies

5 Rent Collection Methods Landlords Should Consider

Many Counties Delay Due Date For Property Taxes This Is Just The Beginning We The Governed

Land For Sale Farms For Sale In Snohomish County Washington Land Com

Individual Property Tax Deadline Extended To June 1 Lynnwood Times

12 Items To Consider With A Residential Estate Sale

Treasurer Michael Baumgartner Sctobaumgartner Twitter

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

The Property Tax Annual Cycle In Washington State Myticor

How To Read Your Property Tax Statement Snohomish County Wa Official Website

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

Many Counties Delay Due Date For Property Taxes This Is Just The Beginning We The Governed

Pdf Larsons V Snohomish County Et Al Division I Washington Court Of Appeals Stafne Declaration In Support Of Larson S Reply To Snohomish County S Response To Motion For Clerical Personnel To

Snohomish County Tribune Newspaper Letters To The Editor

Past Covid 19 Updates Stanwood Wa

Snohomish County Extends Deadline For Individual Property Taxpayers To June 1 My Edmonds News